Reducing Healthcare Costs with Indexed Reimbursement

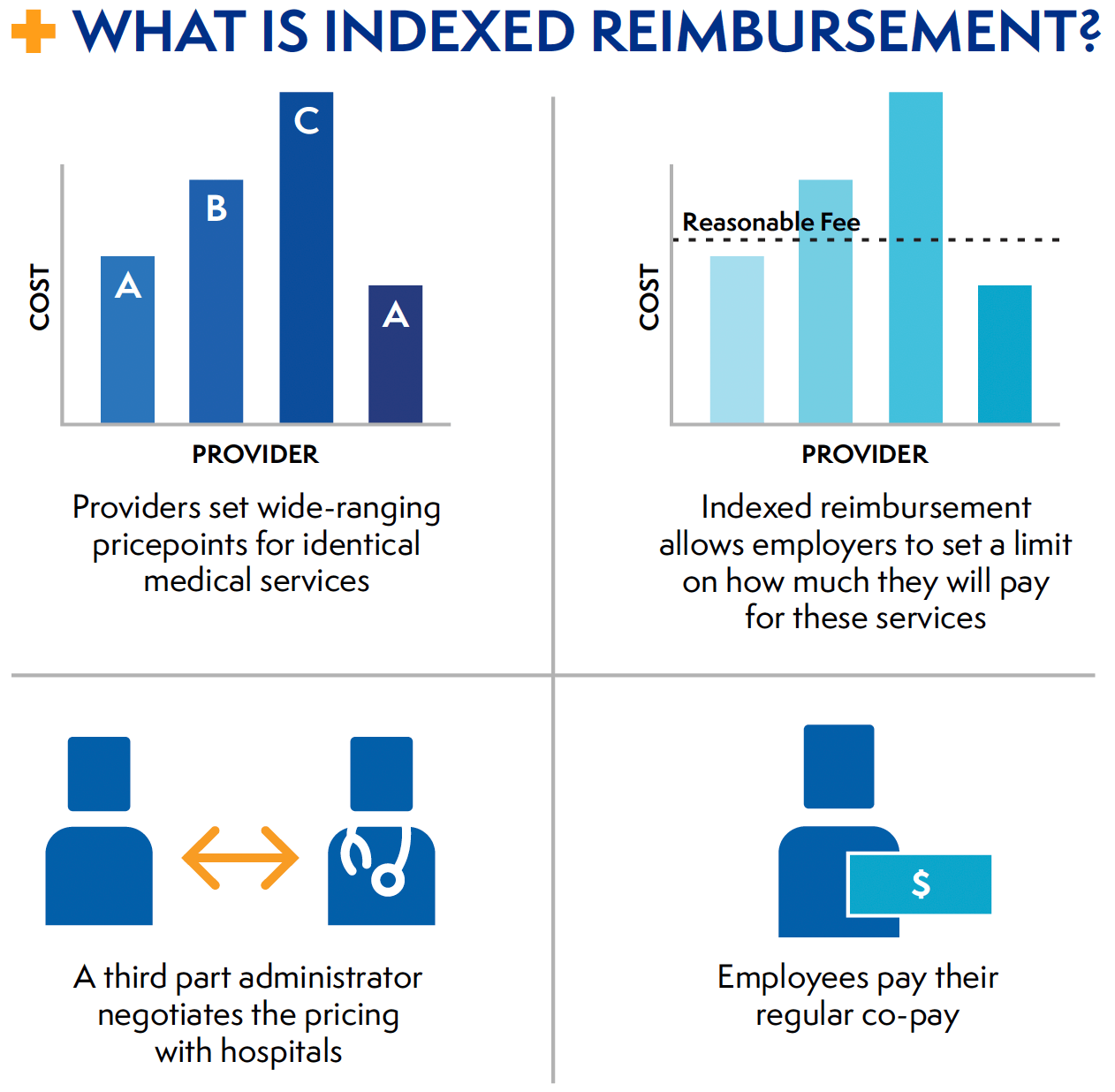

WHAT IS INDEXED REIMBURSEMENT?

Custom plan design, also known as indexed reimbursement or reference-based pricing, is a self-funded form of employer health insurance that limits healthcare costs. Indexed Repricing in the U.S., this strategy allows employers and employees to have more control over healthcare costs.rising healthcare costs in the U.S., this strategy allows employers and employees to have more control over healthcare costs.

Unlike other goods and services purchased in the open marketplace, the cost of healthcare services can vary greatly based on location and among healthcare providers in the same geographic region. A common procedure like a CT scan costs more than 10 times as much at different but similar providers. Often, these costs are far above Medicare pricing. According to Rand, the major carriers’ contracts with hospitals result in payments of 222% of Medicare. The government spends tens of millions to ensure Medicare results in a profit for hospitals. Indexed Repricing helps employers and employees circumvent these discrepancies and acts as a regulating force on providers.

To effectively implement an indexed reimbursement pricing strategy, employers must partner with a third-party administrator (TPA) with the necessary tools to help manage the plan. TPAs help employers provide member services, access the latest medical pricing data and negotiate a reasonable fee with providers.

WHAT ARE THE BENEFITS OF INDEXED REIMBURSEMENT PRICING?

For Employees:

- No more networks

- Increased cost transparency and certainty

- Encourages proactive management of care

For Employers:

- No network negotiations

- Significant healthcare cost savings

- Consistent quality of care

CAN INDEXED REIMBURSEMENT PRICING LOWER MY COMPANY’S AND EMPLOYEES’ HEALTHCARE COSTS?

Implementing indexed reimbursement pricing does not make sense for every employer. For some organizations, it is just not as cost-effective while others may simply not be ready to make the organizational changes necessary.

If you answer yes to several of these questions below, indexed reimbursement pricing may make sense for your company:

- Does your company have 300 or more employees?

- Is your organization fed up with the healthcare insurance status quo and willing to try something different?

- Is your organization’s health plan self-funded?

- Is your organization willing to leave its current health plan carrier?

- Does your organization have the ability to effectively communicate with plan members directly about the need for change in healthcare delivery and engagement?

- Does your organization have an appetite for a longer lead time for transition?

Featured Resources

-

Cut Through the Noise: Why Indexed Reimbursement is the Future of Fair Benefits

The latest national pricing data confirms what many employers already suspect: the same medical procedure can cost two to nine times more depending on the hospital, insurer, or even the contract. A bypass surgery at one Boston hospital, for instance, billed Aetna members nearly $50,000 less than UnitedHealthcare members, according to a recent Fierce Healthcare report on Trilliant Health’s transparency analysis

-

PERMA FAIR Launches Solutions to Address Mounting Health Benefits Crisis for NJ Public Entities

In response to the escalating healthcare cost crisis facing New Jersey’s local governments and school districts, PERMA FAIR Health and Pharmacy (“PERMA FAIR”) has launched a comprehensive platform designed to reduce health benefit costs by up to 25% without compromising coverage or care.

-

How I Found Purpose in a Flawed System

At PERMA FAIR, we believe in providing healthcare benefits that prioritize people. We care about empowering our members and fighting against an unjust system. We can’t fix the industry overnight, but we can give people the tools to stop being taken advantage of.

We Want to Hear From You

Have questions? Want more information? Click below and a representative will be in touch.